Budget Education Program

Build practical money management skills through hands-on learning. Our autumn 2025 program focuses on real-world budgeting scenarios that Australians face every day.

Request InformationHow the Program Works

We don't believe in lecture-heavy courses that put you to sleep. Instead, you'll work through actual budgeting challenges using real data and scenarios. Think of it more like a workshop series where everyone brings their questions and we tackle them together.

Starting September 2025, groups meet twice weekly for guided sessions. Between meetings, you'll apply what you've learned to your own financial situation. It's structured enough to keep you on track but flexible enough to address what matters to your specific circumstances.

- Foundation PhaseWeeks 1-6 cover income tracking, expense categorization, and building your first working budget

- Application PhaseWeeks 7-12 dive into debt management strategies and savings goal frameworks

- Advanced PhaseWeeks 13-18 explore investment basics and long-term financial planning approaches

Your Program Instructors

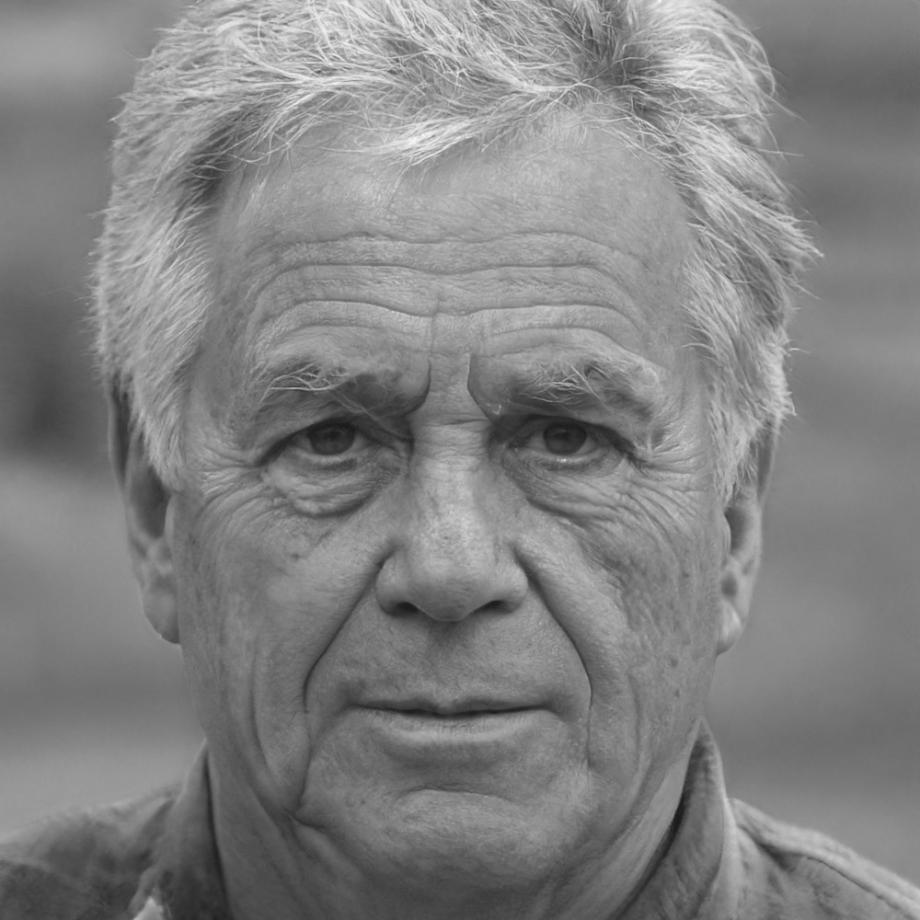

Callum Fitzpatrick

Budget Analysis

Spent 11 years helping families untangle their finances. Callum breaks down complex budget scenarios into practical steps.

Bronwyn Keating

Debt Strategy

Former lending officer who switched sides. Bronwyn knows exactly how debt works and how to manage it effectively.

Henrik Sundqvist

Savings Planning

Henrik teaches the psychology behind spending patterns. His approach helps participants understand their money habits better.

Verity Ashworth

Investment Basics

Verity makes investment concepts accessible. She focuses on fundamentals that actually matter for everyday Australians.

What You'll Actually Learn

Each module builds on previous work. You'll walk away with practical tools and frameworks you can use immediately—not just theoretical knowledge that sits in a notebook.

Module 1: Budget Foundations

6 weeksLearn to track income sources accurately and categorize expenses in ways that reveal spending patterns. We work with your actual bank statements, not hypothetical examples.

- Income documentation and verification methods

- Expense categorization systems that work

- Building a realistic monthly budget framework

- Adjusting for irregular income patterns

Module 2: Debt Management

6 weeksUnderstand how different debt types work and develop strategies for paying them down efficiently. This module addresses credit cards, personal loans, and home mortgages.

- Interest calculation and compound effect analysis

- Debt prioritization strategies

- Refinancing evaluation frameworks

- Building sustainable payment plans

Module 3: Savings and Investment

6 weeksExplore savings goal setting and basic investment options suitable for different risk profiles. We cover superannuation, term deposits, and entry-level share market concepts.

- Emergency fund calculation and building

- Goal-based savings account structures

- Understanding investment risk and return

- Superannuation contribution strategies

Enrollment Details

The next program starts September 15, 2025. We keep groups small—around 20 participants—so everyone gets individual attention when they need it. Sessions run Tuesday and Thursday evenings from 6:30 to 8:30 PM.

Location and Format

Sessions take place at our Tanilba Bay location with an option to join remotely via video conferencing. All materials are provided digitally, though we recommend bringing a notebook for your own planning.

Prerequisites

No prior financial education needed. You should have access to your recent bank statements and be willing to discuss your financial situation in small group settings. Participants range from recent graduates to pre-retirees.